Present value of lifetime annuity

This is because the payments you are scheduled to receive at a future date are actually worth less than the. Payments of an annuity-immediate are made at the end of.

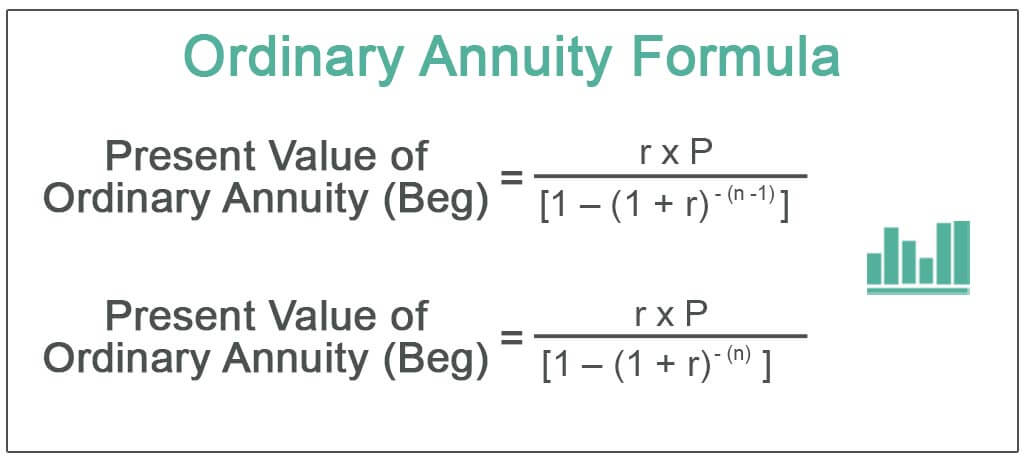

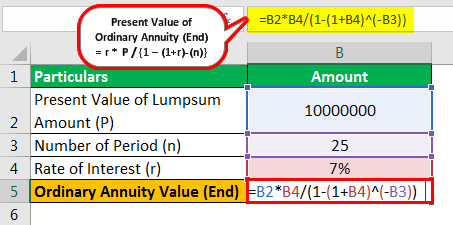

Ordinary Annuity Formula Step By Step Calculation

Head to Head Comparison between Present Value vs Future Value Infographics.

:max_bytes(150000):strip_icc():gifv()/presentvalue_final-25e185ad099a40ce817849fb2cec085e.jpg)

. The value of bonds tends to decline when interest rates rise. The net present value calculator exactly as you see it above is 100 free for you to use. Your email address.

Calculating the present value of an annuity due is basically discounting of future cash flows to the present date in order to calculate the lump sum amount of today. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Present Value of Ordinary Annuity 1000 1 1 54-64 54 Present Value of Ordinary Annuity 20624 Therefore the present value of the cash inflow to be received by David is 20882 and 20624 in case the payments are received at the start or at the end of each quarter respectively.

Those who win the Top Prize or Second Prize have the option to receive a one-time cash lump sum payment in lieu of the lifetime annuity payments. We will guide you on how to place your essay help proofreading and editing your draft fixing the grammar spelling or formatting of your paper easily and cheaply. Valuation of an annuity is calculated as the actuarial present value of the annuity which is dependent on the probability of the annuitant living to each future payment period as well as the interest rate and timing of future payments.

Get 247 customer support help when you place a homework help service order with us. Annuities present a. Formula Formula The present value of an annuity formula depicts the current value of the future annuity payments.

Present value and future value are terms that are frequently used in annuity contracts. Explanation of PV Factor Formula. The present value of an annuity is the sum that must be invested now to guarantee a desired payment in the.

Many retirement experts recommend you stick with fixed annuities. The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where. Value vs future value is a lump-sum payment and a series of equal payment over equal periods of time is called as an annuity.

They offer guaranteed repayments of your purchase price plus a modest return and. I read more. Life tables provide the probabilities of survival necessary for such calculations.

An annuity table or present value table is simply a tool to help you calculate the present value of your annuity. A pension may be a defined benefit plan where a fixed sum is paid regularly to a person or a defined contribution plan. Tax-Deferred Annuity A1in1.

Equivalent Annual Annuity Approach - EAA. N Number of periods in which payments will be made. The present value of your annuity is the total cash value of all future payments after factoring in the discount rate.

There are three main types of annuity contracts. An annuity which provides for payments for the remainder of a persons lifetime is a life annuity Types. A pension ˈ p ɛ n ʃ ə n from Latin pensiō payment is a fund into which a sum of money is added during an employees employment years and from which payments are drawn to support the persons retirement from work in the form of periodic payments.

PMT Dollar amount of each payment. For Life prizes are guaranteed for a minimum of 20 years. Leave a Reply Cancel reply.

If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase. ASCII characters only characters found on a standard US keyboard. The lump sum option for the Top Prize is 5750000 before taxes.

The present value of an annuity immediate is the value at time 0 of the stream of cash flows. The present value of a 5-year annuity with a nominal annual interest rate of 12 and monthly payments of 100 is. Present Value of an Ordinary Annuity.

A lower discount rate means a higher present value and vice versa. For example you would keep more of your money if one purchasing company offers a 10 percent discount rate compared with 14 percent from another company. And annuities tend to hold their carrying value better over time.

5500 after two years is lower than Rs. The equivalent annual annuity approach EAA is one of two methods used in capital budgeting to compare mutually exclusive projects with unequal lives. Must contain at least 4 different symbols.

The lump sum option for the Second Prize is 390000 before taxes. Retirement annuities promise lifetime guaranteed monthly or annual income for a retiree until their death. Diagrammatic representation of present value vs future value.

Based on the time value of money the present value of your annuity is not equal to the accumulated value of the contract. PRO Plus Lifetime Access. Click the Customize button above to learn more.

An annuity is a financial instrument issued and backed by an insurance company that provides guaranteed monthly income payments for the life of the contract regardless of market conditions. Present value means todays value of the cash flow to be received at a future point of time and present value factor formula is a toolformula to calculate a present value of future cash flow. Future Value of.

Present Value of an AnnuityC11i. Concise Encyclopedia of Economics 2nd ed. 6 to 30 characters long.

Get 247 customer support help when you place a homework help service order with us. Annuities may be classified in several ways. Lifetime Access to Our Premium Materials Read all 2238 Testimonials.

Valuation is the calculation of economic value or worth. PV of Annuity Due 500 1 1 1 1212 12 1 12 PV of Annuity Due Explanation. The present value interest factor of annuity is a factor that can be used to calculate the present value of a series of annuities.

P Present value of your annuity stream. Future Value of a Single Amount. Lifetime catch up taxes and investment options.

R Discount or interest rate. As present value of Rs. Meaning Formula and Example.

More Guaranteed Lifetime Withdrawal Benefit GLWB. Present Value of an Annuity. The term deferred annuity refers to the present value of the string of periodic payments to be received in the form of lump-sum payments or installments but after a certain period of time and not immediately.

5000 it is better for Company Z to take Rs.

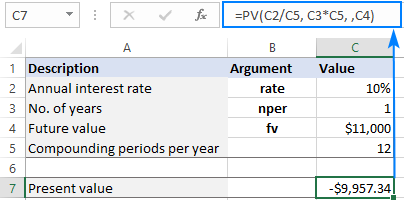

Present Value Formula And Pv Calculator In Excel

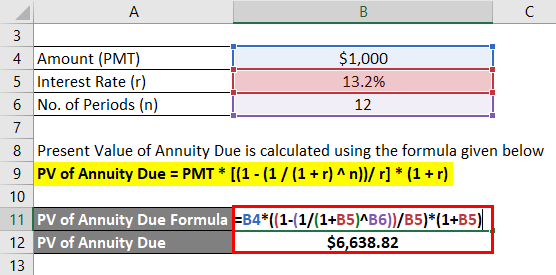

Present Value Of Annuity Due Formula Calculator With Excel Template

Present Value Of An Annuity How To Calculate Examples

Present Value Of An Annuity Meaning Formula And Example

Calculating Present Value Accountingcoach

Using Pv Function In Excel To Calculate Present Value

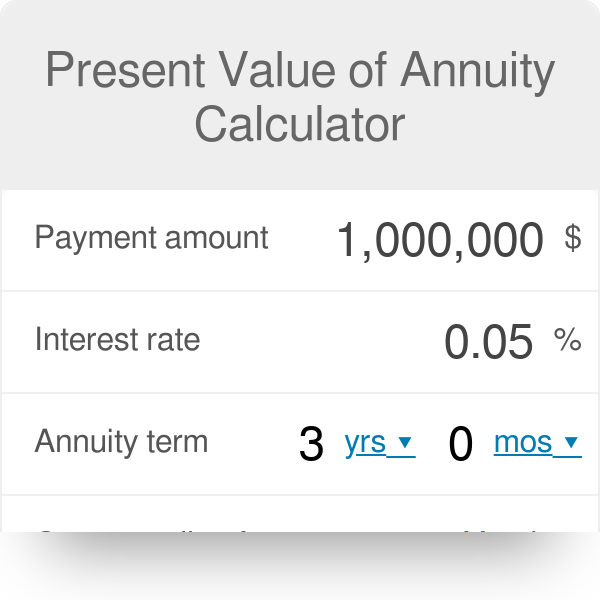

Present Value Of Annuity Calculator

Present Value Formula Calculator Examples With Excel Template

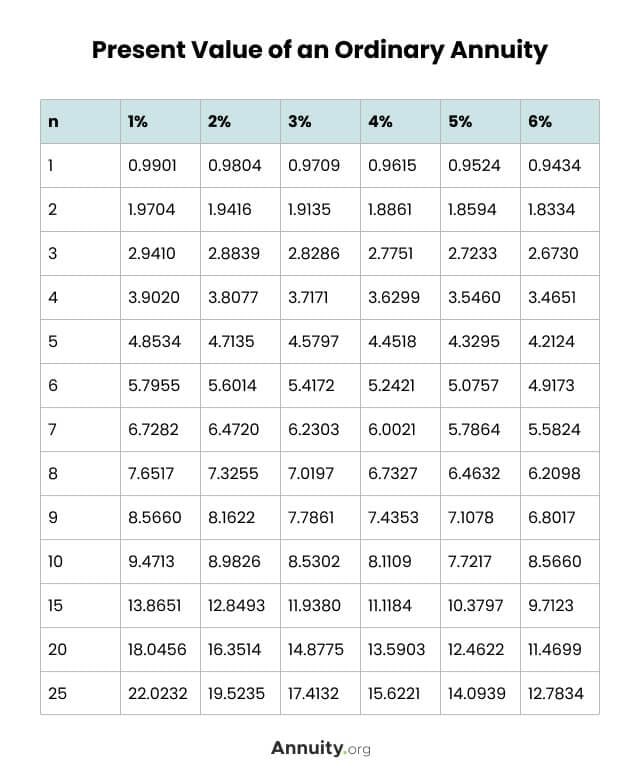

What Is An Annuity Table And How Do You Use One

Present Value Of Annuity Due Formula Calculator With Excel Template

Annuity Calculation In 9 Minutes Annuities Explained For Present Value Of An Annuity Formula Youtube

Present Value Of An Annuity How To Calculate Examples

What Is An Annuity Table And How Do You Use One

Present Value Of An Annuity Calculator

:max_bytes(150000):strip_icc():gifv()/presentvalue_final-25e185ad099a40ce817849fb2cec085e.jpg)

What Is Present Value Pv

Ordinary Annuity Formula Step By Step Calculation

Definition Of Net Present Value Financial Calculators Financial Education Financial Problems